The General Services Administration (GSA) is a federal agency that provides centralized procurement for the federal government, offering billions of dollars worth of products, services, and facilities that federal agencies need to serve the public. Since GSA was created by President Harry Truman on July 1, 1949, it’s original mission was to dispose of war surplus goods, manage and store government records, handle emergency preparedness, and stockpile strategic supplies for wartime through a bidding and selection process. Over the years, the General Services Administration has changed quite a bit to impact a variety of industries – healthcare being one example.

Today, GSA provides workspace to more than 1 million federal civilian workers, oversees the preservation of more than 480 historic buildings, and facilitates the federal government’s purchase of high-quality, low-cost goods and services from quality commercial vendors.

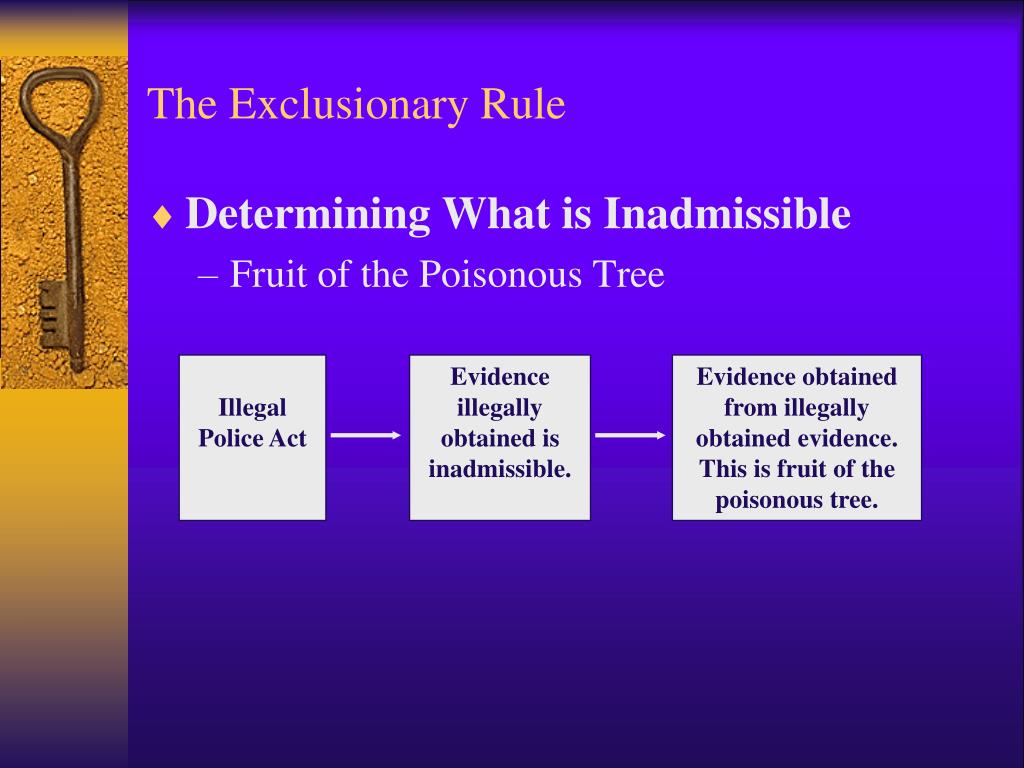

The Ugly – Freddie/Fannie blacklists.Appraisers listed here may as well change careers, or specialize in non-GSE work.Large lenders that sell to Fannie/Freddie must comply.How can AMCs comply with this list if they are never provided with it?.Field reviews ordered on all reports from appraisers on these lists. The Freddie Mac Exclusionary List is the list compiled, maintained and distributed by Freddie Mac conta in in g names of in dividuals or entities that have been excluded from participat in g in transactions or do in g bus in ess, directly or in directly, with Freddie Mac.

GSA and the Excluded Parties List System (EPLS)

Since this federal agency (GSA) was responsible for bidding, selecting, and managing federal contracts, it also was responsible for maintaining a list of companies that were in good standing to continue doing business under a GSA contract, or whether to debar or sanction them.

What is the Excluded Parties List System (EPLS)?

In the event the GSA debarred or sanctioned a company for fraud or breach of contract, they would end up on the GSA’s Excluded Parties List System (EPLS). Once on the EPLS list, the federal government or any company that provided services and utilized a GSA excluded/sanctioned/debarred company cannot use the services of such a company.

EPLS Transition to SAM.gov

The EPLS was maintained and updated by the GSA until the list was moved to a new database service called the System for Award Management (SAM.gov). This new database (SAM.gov) combines several federal procurement systems and the Catalog of Federal Domestic Assistance into one new system.

SAM.gov includes the following federal agency records:

- Central Contractor Registry (CCR)

- Federal Agency Registration (Fedreg)

- Online Representations and Certifications Application

- Excluded Parties List System (EPLS)

Smarter Provider Exclusion Monitoring

Freddie Mac Exclusionary List 2018

SAM.gov, OIG LEIE, State Medicaid Exclusion Lists

Best practice for finding exclusions is to search SAM.gov in addition to the OIG List of Excluded Individuals and Entities (LEIE), and each available state Medicaid excluded or terminated providers list. This way, you get a complete picture and search all available federal datasets of excluded or sanctioned and debarred persons or companies.

Luckily, many of these checks from multiple sources can now be automated, saving you critical time and money while also reducing risk to keep you compliant. ProviderTrust offers healthcare exclusion monitoring solutions for a holistic approach to ongoing exclusion screening and provider license verification.

Check out our latest resources!

Fmel

Written by Michael Rosen, Esq.

Freddie Mac Exclusionary List Download

Michael brings over 20 years of experience founding and leading risk mitigation businesses, receiving numerous accolades such as Inc. Magazine’s Inc. 500 Award and Nashville Chamber of Commerce Small Business of the Year.

Over the years I’ve created content around the Freddie Mac Exclusionary List – videos, Crushing Debt Podcast episodes and blogs. Put simply, the Freddie Mac Exclusionary List is a list of real estate professionals that Freddie Mac believes have taken some action, failed to take some action, originated loans, or have some systemic failure that caused harm to the mortgage origination of loan products bought or backed by Freddie Mac.Your inclusion on the List has no correlation to criminal law, although we have seem some cases where Freddie Mac refers the person on the List to the appropriate licensing or governing body.We have never encountered a situation where there was any fine or monetary penalty imposed by Freddie Mac.

In August 2016, I wrote a blog outlining my experience with getting real estate professionals off of the Freddie Mac Exclusionary List and created the following list of documents that I suggested someone use in support of a request to come off of the Exclusionary List:

- Policy Manual;

- Job Description;

- Letters of Recommendation from superiors or clients;

- Certificates from continuing education received or taught;

- Public Record documents;

- Any other relevant documents

As a supplement to that post, below are some additional documents clients have provided to successfully show Freddie Mac they deserve to come off of the Exclusionary List:

- An affidavit describing your situation, why you should not be on the List and why you should come off of the List (In other words, what has changed since you went on the List – what have you “learned” about what you did “wrong”);

- A resume or CV;

- YouTube Videos, and other social media promotions or commercials;

- Testimonial letters from clients;

- Proof of awards won in the industry;

- Proof of community involvement, with your religious organization, homeowner / condo association, or other charitable organization;

- Credit Report or other proof of “financial responsibility.”

To tie all of this together, we will write a letter on your behalf that emphasizes the positive arguments around why you should come off the Exclusionary List, referencing all or as many of the above documents as you can provide.

Once the package is submitted to Freddie Mac (and they now take electronic submissions) we normally get a response within 45 – 60 days. We still have a challenge in that Freddie Mac does not provide any explanation (positive or negative) in their decision – they simply issue a letter of congratulations, or a letter of denial. However, we have been successful many more times than not in helping our clients come off of the Freddie Mac Exclusionary List.

We may be able to help you come off of the Freddie Mac Exclusionary List too.For more information, please contact us to schedule a free initial consultation to discuss your options at 727-261-0224' target='_blank'>727-261-0224 or email me directly at shawn@yesnerlaw.com. Please also subscribe to the Crushing Debt Podcast, on Apple Podcasts, Spotify, and other podcast players, including Amazon Echo (“Alexa”) for more free information about this topic.

Shawn M. Yesner, Esq., is the host of the Crushing Debt Podcast and founder of Yesner Law, P.L., a Tampa-based boutique real estate and consumer law firm that helps clients eliminate the financial bullies in their lives. We assist clients with asset protection, the sale and purchase of real property, Chapter 7 liquidation, Chapter 13 reorganization, bankruptcy, foreclosure defense, debt settlement, landlord/tenant issues, short sales, and loan modifications in Tampa, Westchase, Odessa, Oldsmar, Palm Harbor, Clearwater, Pinellas Park, Largo, St. Petersburg, and throughout the greater Tampa Bay area.